South America is not united, as it might become one day. once thriving countries; Venezuela, Ecuador, Paraguay, Bolivia, and Argentina are recovering. Investment comes in many shapes and forms. The region’s home to nearly 670 million people, and has a diverse range of economic drivers and plenty of natural resources.

Closing 2025 Latin American bond sales bested those investment bankers who had predicted modest growth in a year of heightened volatility. In 2025 those companies and governments from southamerica sold around $184 billion of debt abroad so far this year, A result with almost 50% from 2024. The figures are a record in data going back to 2014 compiled by Bloomberg, but longtime market watchers — were even stunned by this kind of surge.

Investing in South America is easier than it was used to be. The region continues to grow which inturn makes it even easier. South America is ready to make money via important changes and they have all gotten a taste of the good life, they are ready to keep working for it.

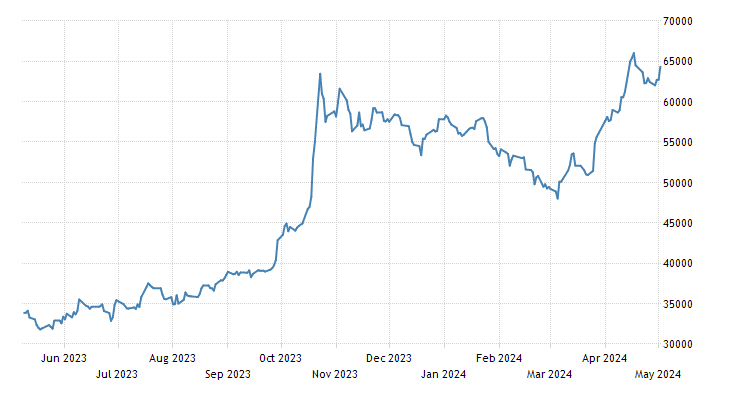

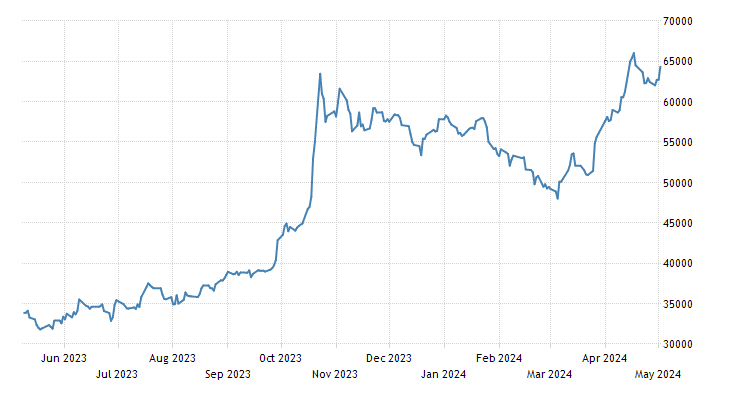

Over the long term, the combined Latin American stock markets have performed well. In the past two decades to the end of May 2024, the MSCI EM Latin America Index has returned 549.50% versus 466.19% for the MSCI Emerging Markets Index. Meanwhile, the MSCI AC World Index grew by 563.14%.

Latin America, a region known for its volatility, and for several other reasons, such as political and economic cycles, plus a regulatory uncertainty. This is something you know they have to deal with in Latin America. Inflation and interest rates are expected to fall in most countries in the region, there should be a value hike in the fixed-income market in the medium term. Up for Grabs is real estate in those countries which have suffered a population demise. House prices, plenty of opportunity in the real estate sector.

South America is not united, as it might become one day. once thriving countries; Venezuela, Ecuador, Paraguay, Bolivia, and Argentina are recovering. Investment comes in many shapes and forms. The region’s home to nearly 670 million people, and has a diverse range of economic drivers and plenty of natural resources.

Latin America has again become more important to investors within emerging markets, particularly if you’re looking for growth and diversification. The region’s home to nearly 670 million people, most of them consumers and has a diverse range of economic drivers and plenty of natural resources.

A friend told me once: "Only when the people get used to you and start seeing you as one of their own you may have a chance to survive and even prosper in a business there". The mentality is NOT as business-like as in Europe or in the USA. Latin Amerricans work to help each other. The newer generations are changing a little, but in general, the level of solidarity is by far greater than the need to make lots of money from one’s business.

Investing in Latin America carries risks, increasingly so has Europe. A well enough place for Risk Capital.

Latin America is at the center of an unprecedented economic transformation. Investment in infrastructure, its adaptation to global mega-forces, and ability to take advantage of its demographics and natural resources put it in an advantageous position. Investors who recognize and act on these characteristics will be well-positioned to benefit from a rising region. In this context, the key will be to stay flexible, adapt to changes and always be on the lookout for the next wave of opportunities.

Consumers are increasingly warming up to purchase products over social media apps. From 12% to 41%.