Investing in Latin America in 2025 is still very good, many invest in the region they are focused on, the entire Spanish-speaking market, in countries such as Mexico, Colombia, Ecuador and Peru, but we also keep our eyes open to the opportunities in Brazil, Venezuela.

All payments in Stocks are orderly registered. The countries have register of the invested amount displayed. The optimism to bet on innovation in the South American region and creating win-win situations comes naturally. Basically you can escape the depressed EU - USA-Oceania feeling. We offer new ways, In the first nine months of 2021 it started, Latin American startups attracted an amount of capital greater than that raised in the previous six years combined. The pandemy has hit South America hard. It's time to wake up.

Closing 2025 Latin American bond sales have stunned forecasts from those investment bankers who had predicted otherwise, that at best, modest growth in a year of heightened volatility amid Donald Trump’s return to the White House would develop. Companies and governments from the region sold just over $184 billion of debt abroad so far this year, a jump of almost 50% from 2024. The figures are a record in data going back to 2014 compiled by Bloomberg, but longtime market watchers — themselves stunned by the surge — say it’s likely the best year ever.

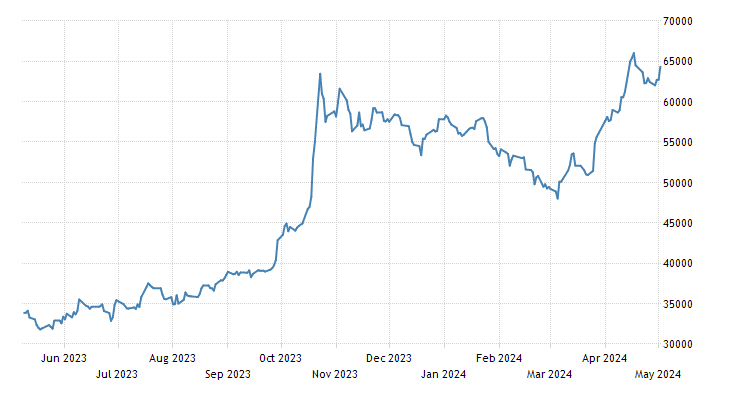

The Caracas stock exchange, is one of the few companies in Venezuela that has grown. The size of the stock market makes the market very attractive Currently moving about US$ 50,000 a day. What you won't find here is the famous glamorization of the founder and a subsequential entrepreneurial lifestyle. Marketing opportunities are on every level, reach out to find out more. For newcomers to make sure your investment interest is earnest you need to put down a lump payment.

The Latin American market is much more mature than several years ago due to the pandemic, it seems that the rebound is not just a coincidence, but also a movement fueled by the growing digitalization of the world and the disruption of legacy industries.

What is new, however, is that foreign financial investors are not currently deterred by an uncertain outlook - on the contrary: Since the beginning of the year, it has been mainly foreign capital that has been moving the stock markets in the region.

The stock exchanges in Brazil, but also in Peru, Colombia and Chile have gained significantly since the beginning of the year. The need exists to proof that all investment sources are legit.

In stark contrast to the leading stock trading centers in Europe, the USA and Asia. Venture capital investors continue to focus on Latin America. Last year, around 15 billion dollars flowed into Latin America as venture capital. That is around three times as much as in the previous record year of 2019. By comparison: In Asia (excluding China), venture capital funds invested around 25 billion dollars last year.

At the same time, many investors expect that prices for raw materials will rise and are betting on mining and agricultural companies, of which there are numerous in Latin America. The inflow of capital has led to a strengthening of the region's purchasing power: in Brazil, but also in Peru, Mexico and Chile, currencies have risen sharply against the dollar. Venezuela is an emerging market with a high growth potential: Venezuela offers a recovering economy with potential. The country has a young and growing population, as well as abundant natural resources. Advantages of investing in the BVC that offers international investors a series of advantages and securities.

Consumers are increasingly warming up to purchase products over social media apps. From 12% to 41%.